pros and cons list carbon tax

Many companies cant reduce their emissions as much as theyd like to. A carbon tax can be very simple.

Carbon Tax Pros And Cons Economics Help

Don Fullerton the Nannerl Keohane Distinguished Visiting Professor for Spring 2015.

. Production Shift It is possible that companies will move production or their business to places that have lower or no carbon taxes also known as pollution havens. However some differences exist. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint.

List of Cons of Carbon Tax. Adjustments in consumption behavior. A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources.

Proponents claim that a carbon tax would be the most cost-effective way to cut carbon-dioxide emissions. The Pros of Carbon Offsetting. A carbon tax increases energy costs in proportion to the carbon content of the source of energy.

Most supplies are either provided by. But the carbon tax keeps running aground. The low-income earners will end up paying a substantial percentage of their income for necessities like food electricity and gasoline.

Pressure for faster energy transition process. Unfortunately this would also create a major disadvantage as the carbon tax will most likely hurt low-income and middle-class families as this will increase the cost of many goods used in. Companies may go out of business.

Solar panels wind turbines nuclear power plants and electric cars are no longer enough to mitigate the risks posed by human-driven climate change. Companies may switch to green energies. Implementing a carbon tax is far from the no-brainer Harris and McAfee seem to believe and its impact is unlikely to do more than marginally accelerate a process that capitalist markets are already fueling.

Arguments Against Carbon Taxation. Keith Orchison says a carbon tax on fossil fuels is unlikely. The potential of a carbon tax might be worth over 100 billion per year in the United States but it is also a system which requires a.

A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions. Carbon pricing is regressive. Some countries have a carbon tax yet governments are often keener to adopt measures other than a tax.

Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy. A carbon tax would hit lower-income families the hardest said CBO because low-income households generally spend a larger percentage of. The administration of a carbon tax has relatively high fees.

Effectiveness depends on tax design. If a carbon tax isnt a global initiative then there will be pockets on the planet where corporations and certain individuals will be able to find refuge from these additional fees. Incentive to avoid fossil fuels.

Since the government regulates how much emissions are allowed emissions will never rise past their cap. Carbon Tax Pros Carbon Tax Cons. The downside is that you need to guess how high to.

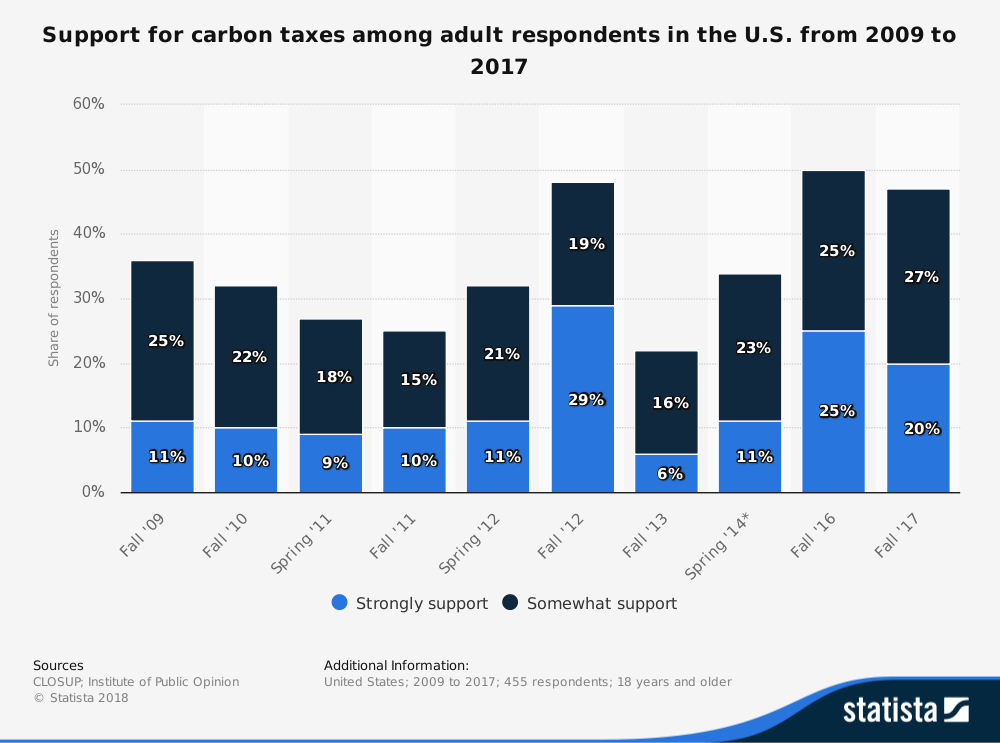

The IMF estimates a 75 a ton carbon tax will lead to the amount of emissions scientists estimate will correspond to 2 C of warming. At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their manufacturing processes by levying a tax that increases their cost. The proponents claim this would be easy to administrate as there are already special taxes in place in the energy sector that can be used as the foundation to the new carbon tax policy.

A much more straightforward plan is simply to tax carbon directly. Discussion about carbon price. The business community would not accept the impact on energy costs.

Were a carbon tax policy to begin to move through a future Congress one giant headache would be. Also carbon taxes provide a broader scope in terms of emission. Companies may relocate to other countries.

A carbon tax is a simpler blunter tool which is easier to administer and regulate. Carbon taxes only target carbon dioxide emitted from fossil fuels leaving out other carbon compounds such as methane from agriculture. The problem with a carbon tax is that almost no one uses any form of renewable energy on a regular basis.

It is easier and quicker for governments to implement. Almost everyone uses carbon-based fuels exclusively. The Pros and Cons of Carbon Tax.

At that level coal prices would rise by more than 200 above. Higher carbon tax rates cause larger changes in energy prices. It removes the arbitraging games and artful dodges that have helped undermine cap and trade schemes in places like Europe but in return it requires that politicians vote for a tax.

Contrary to that the carbon tax has a chance to incentivize emissions even lower than a set goal but there is no guarantee. Carbon offsetting has benefits at both ends of the process. Pros and cons of a carbon tax Executing the policy.

An increase in the cost of fossil fuels will impose a harsh burden on low-income earners. Lower emissions mean cheaper everything allowing for greater profit margins. Political solutions to climate change are as every activist monitoring the COP negotiations should know by now largely ineffective.

Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage. There are three big problems with the concept. On account of the different carbon-intensity of fuels price impacts are most significant for energy produced with coal then petroleum then natural gas.

What Are the Cons of a Carbon Tax. This could have an economic impact especially when trade-offs would fail to help the economy in general. The Pros and Cons of Taxing Climate Change.

A climate change economist discusses effectiveness of a carbon tax. Proponents of a carbon tax often argue that assigning a fee to carbon dioxide pollution is. Companies and people will just leave the countries where taxes are implemented.

Instituting a carbon tax could help reduce the deficit and produce incremental benefits for. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. And indeed that they keep voting to raise it year after year.

If the policy were to be enacted a large percentage of a countrys carbon emissions will be monitored and sanctioned. List of the Cons of a Carbon Tax. A carbon tax also has one key advantage.

List of the Disadvantages of a Carbon Tax.

Carbon Tax Pros And Cons Economics Help

/GettyImages-97615566-5b58f1ddc9e77c00713cdd3c.jpg)

Carbon Tax Definition How It Works Pros Cons

Carbon Tax Pros And Cons Economics Help

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Disposable Plastics And Recycling Trends

Carbon Tax Pros And Cons Economics Help

Carbon Tax What Are The Pros And Cons Climateaction

Pros And Cons Of State Of The Art Approaches Download Scientific Diagram

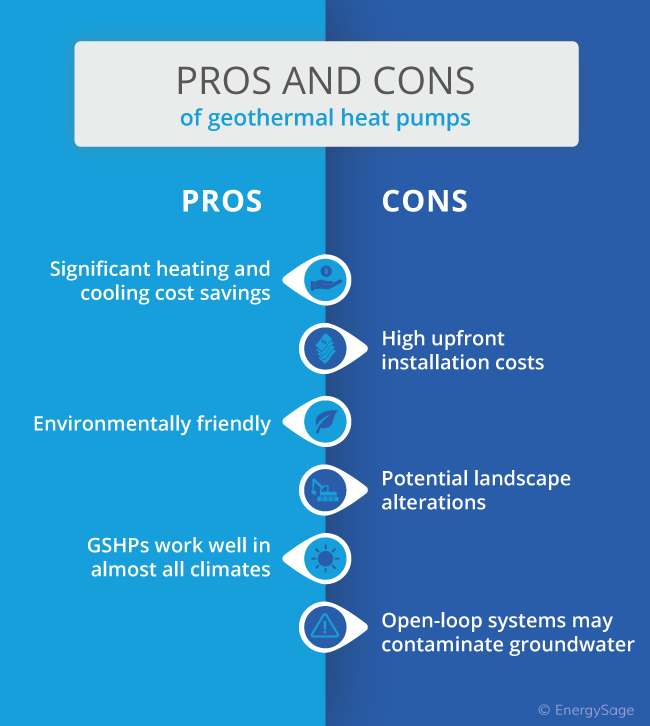

Pros And Cons Of Geothermal Heat Pumps Energysage

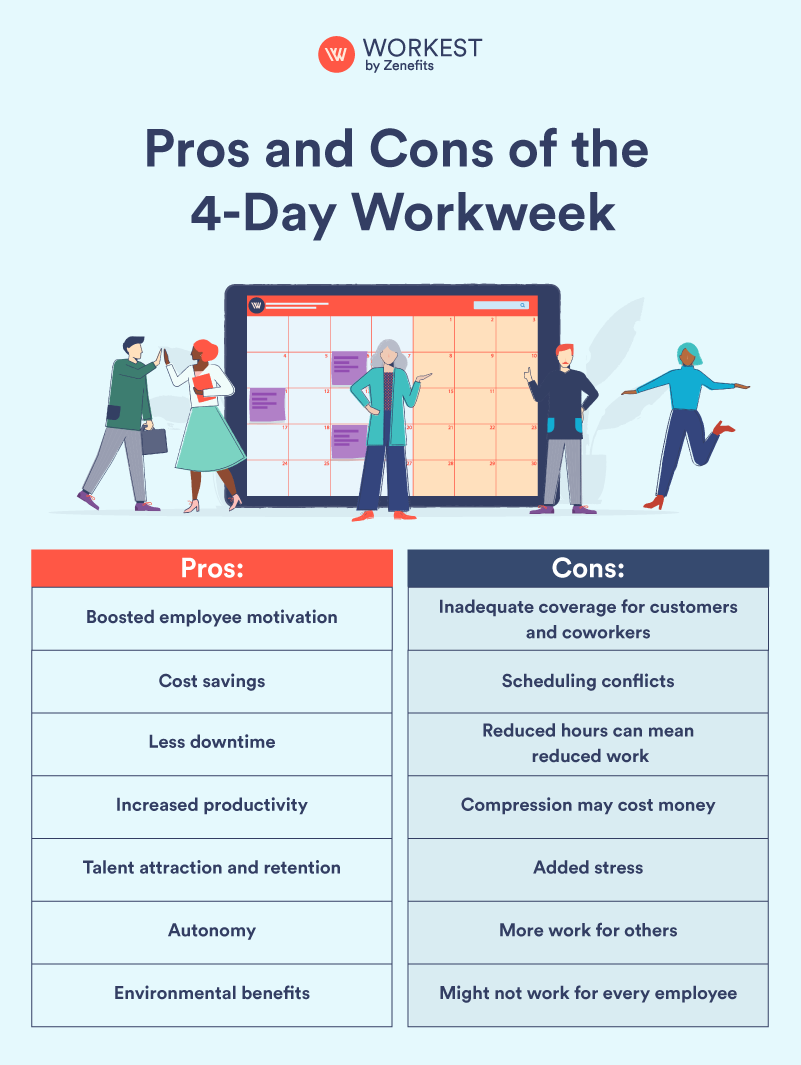

The 4 Day Workweek Pros And Cons Workest

The Pros And Cons Of Autogas Systems Gazeo Com

27 Main Pros Cons Of Carbon Taxes E C

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Pros Cons Of A Plastic Bag Ban Factory Direct Promos

Carbon Tax What Are The Pros And Cons Climateaction

Carbon Tax Pros And Cons Economics Help

Key Advantages And Disadvantages Of Alternative Marine Fuels Download Scientific Diagram